Updates on CO Loan Limits

This is super exciting. I’m back in for another update. And I love this time of year because we get our new loan limits, which is amazing.

So, loan limits are put out by the FHFA. What happens is every single year, they do a study based on all of the counties across the country. In the study, they look at the median home prices and the median income, and then they look at the conventional loan amount. So, across the country in the year of 2023, the maximum conventional loan amount is now going to be $726,200.

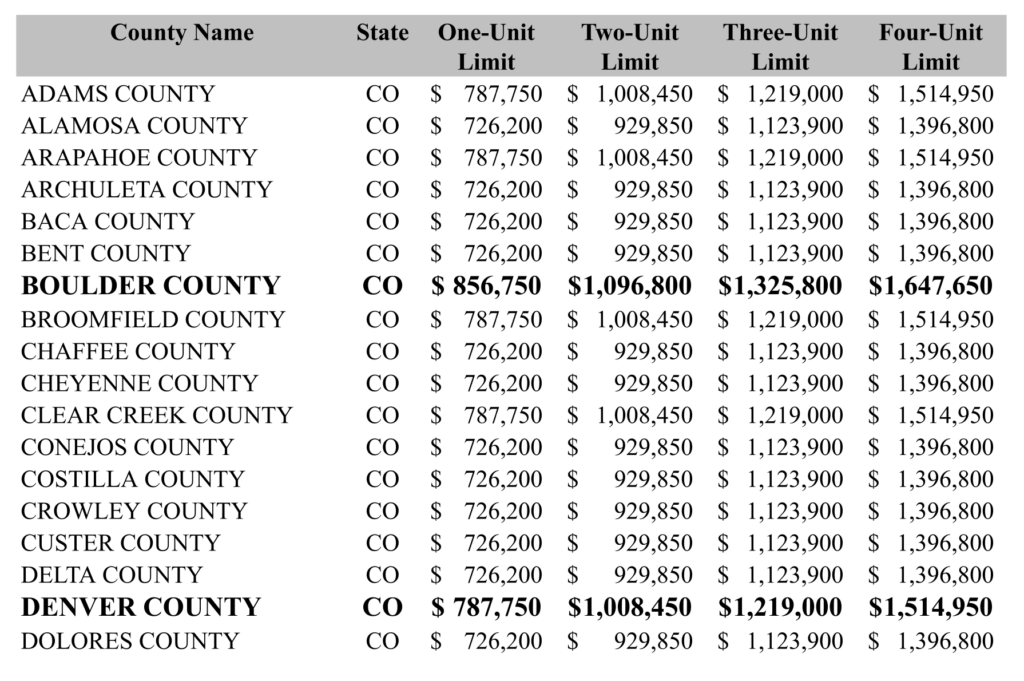

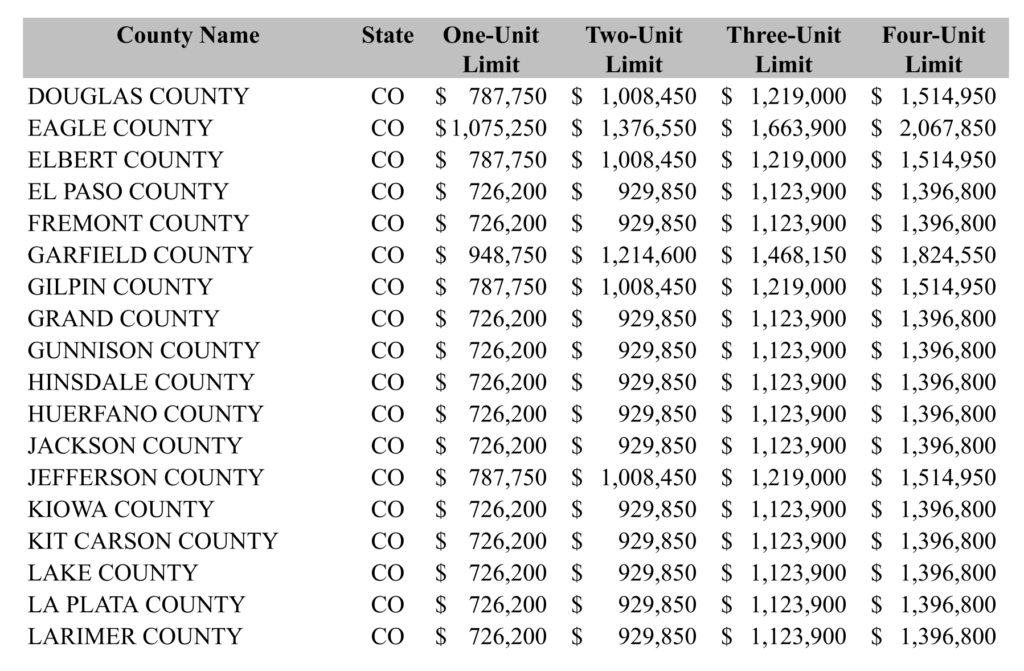

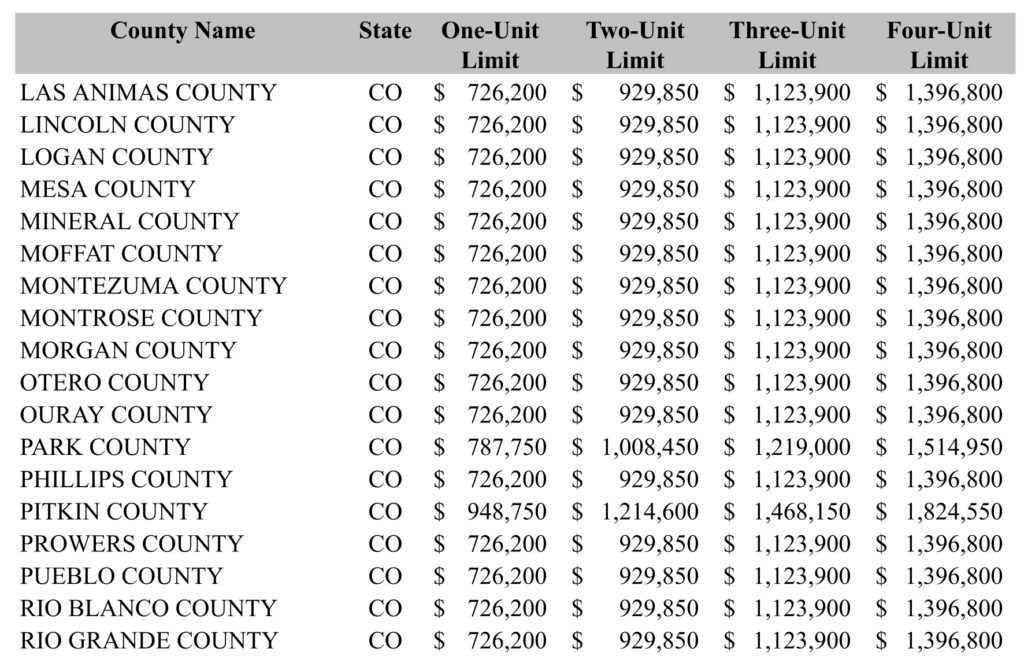

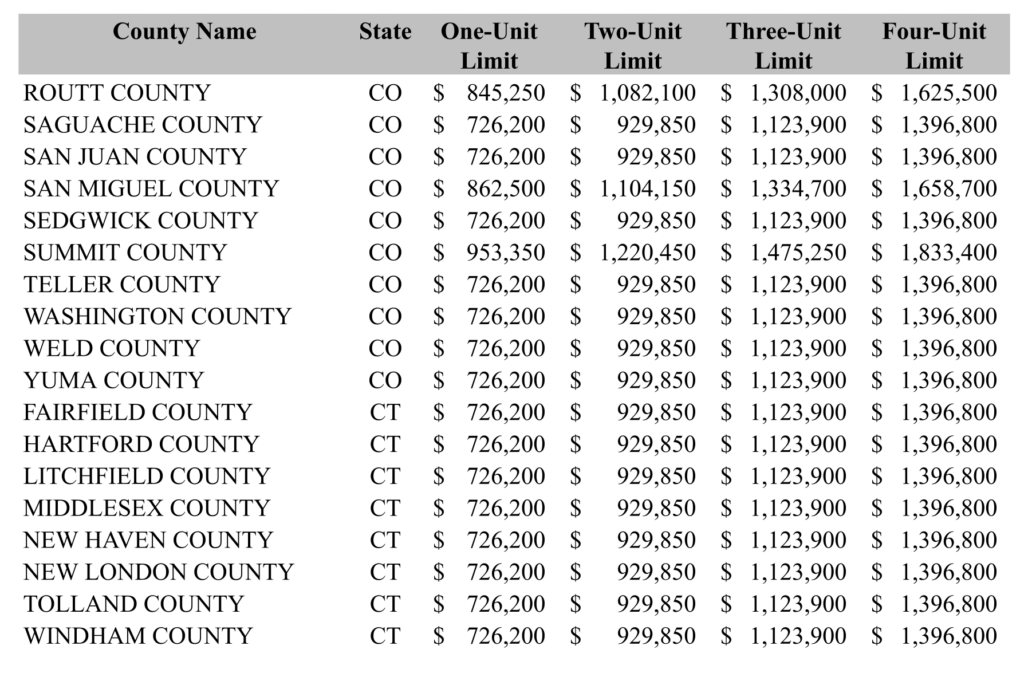

But then they look at a county-by-county basis and figure out if the conventional loan limits should go higher. So… Just to show you really quick what we got here, and I’ll put this in the email as well. Here’s a list of conventional loan limits. I really focus on two of them here. Boulder county this year goes up to $856,750. Denver County goes up to $787,750. And the list goes on and on and on.

Also, we look here at two-unit, three-unit and four-unit properties, right? Boulder county, you can buy a duplex and get a conventional loan with the loan amount up to $1,096,000. So, I think it’s really important for us to look at these loan limits because there’s a lot of reasons why we would look at a conventional loan versus a jumbo. I’ll give you an example. I had one we were comparing earlier today.

The borrower was getting gift funds and the jumbo loan program just didn’t or non-agency program just didn’t allow for the gift funds, whereas a conforming loan did. So, there’s always going to kind of be these pros and cons going back and forth of why when we get up into these higher loan amounts, we want to look at conventional versus jumbo. Another example could be one year tax returns.

If you have a self-employed person and they’ve been in the business for five years or longer, we could get a conventional approval that only requires one year tax returns. Yes, there are some jumbo programs allow that as well, but then we have to look at the difference of interest rates.

Another example would be a property inspection waiver. You might have a purchase. We run it through the AUS for either Fannie Mae or Freddie Mac and we get an appraisal waiver. An appraisal waiver is never something we would get on a jumbo or non-agency transaction. So, you know, there’s all kinds of tit for tat back and forth and why we would look at a conventional loan versus a non-agency or jumbo loan. But certainly, seeing these loan amounts move up for counties across the state of Colorado is really exciting because I think it opens up some more opportunities for us.

Another thing means that now in Boulder County, if you’re a first-time home buyer, you can buy a home with 3% down at a maximum conforming loan amount of $856,750. So, for first time home buyers it opens up a higher number of properties that could be available based on 3% down payment options.

So, super excited to see the changes. I’ve been waiting for this one to come out and I’m super happy to see it. I’m around. If you have any questions, let me know. Hope you’re having a great day.

-Brian

303-500-3839

________________________________________________________________________________

Questions? Concerns? Ready to get started with my strategic buyer consultation?

Call me any day of the week, Monday- Sunday to get connected & learn about your options.

It’s never too soon to understand what you can afford!

303-500-3839

Brian@BrianManningTeam.com

LICENSED TO SERVE YOU IN:

- Colorado

- California

- Arizona

- Illinois

- Florida

- Wyoming

Oh yeah, want to get my weekly Friday Market Update straight in your inbox?? Join our mailing list!

Email me directly at Brian@BrianManningTeam.com